free math tutoring online

Tuesday, August 31, 2010

Retirement Calculator Evaluation - Vanguard

Overall, I thought the Vanguard Retirement Calculator was a reasonably accurate estimator for how much is needed. It takes salary growth (due to inflation), social security payments, and life expectancy during retirement into account.

Overall, I thought the Vanguard Retirement Calculator was a reasonably accurate estimator for how much is needed. It takes salary growth (due to inflation), social security payments, and life expectancy during retirement into account.However, if one is more than 10 years from retirement, you may need to make an adjustment to one’s estimated salary. The calculator does not account for the possibility that your salary may grow faster than inflation during your early working years – e.g. due to promotions or job changes. For those that are 10 or more years from retirement, it may be necessary to project what your! future salary may be and put the present value in the salary column. (For specifics on this economic-speak, see example #2 below.)

This calculator asks for the following information:

1. Household Income

2. Percentage of Income Needed after Retirement

3. Social Security Benefts

4. Annual Pension Benefits

5. Current Savings

6. Annual Retirement Savings Contribution

7. Annual Investment Returns

8. Years Until Retirement

9. Years in Retirement

After filling out the information, the calculator lets one know whether you have sufficient savings or the amount that one needs to save before retirement.

Example 1 – Will B. Retired is a 64 year old that will retire next year. Here is his information.

1. $50,000 total income

2. 100% income needed in retirement

3. $25,560 Social Security (used 55 year old numbers)

4. $20,000 annual pension

5. $1! 0,000 savings

6. $5,000 savings per year

7. 8% savin! gs retur n in retirement

8. 1 year until retirement

9. Life expectancy – 95, i.e. 30 years in retirement

Income needed for retirement. $52,000 in year 1. The calculator shows that Will’s retirement income will be $48,786. Most of it is covered by Social Security and his pension. This situation is acceptable since Will is so close to retirement. However, the calculator recommends Will needs to save about $185,000 more to account for the possibility of higher inflation. Thus, Will savings is currently short and should work longer before retiring.

Example 2 – Em. S. Grad is 35 years old and plans to retire at 65. Em’s information is different that Wills in #3 (social security payments), #4 (assume there are no longer pensions), and #8 (30 instead of 1 year to retirement). In addition, Em expects to retire as a Division Manager, which has a current salary of $150,000.

1. $50,000 total income

2.! 100% income needed in retirement

3. $28,638 Social Security

4. $0 annual pension

5. $10,000 savings

6. $5,000 savings per year

7. 8% savings return in retirement

8. 30 year until retirement

9. Life expectancy – 95, i.e. 30 years in retirement

Amount needed for retirement: $1,266,596 to enable $162,000 per year of retirement income. And the calculator judges that Em is on track to provide $152,036 per year, assuming Social Security payments increase at the rate of inflation. Thus, Em will need to save about $1250 more per year to reach his goal.

However, the calculator doesn’t account for non-inflation related salary increase. Thus, $1,266,596 should be Em’s minimum retirement savings target.

To account for a higher salary due to promotion or job change, I recommend that Em should use the present salary of the position he expects have in the future. For example, if Em expe! cts to be a division manager when he retires, he should input ! the $150 ,000 salary of a division manager today. (For reference, I also changed the Social Security payment to the maximum of $36,864.) With this adjustment, here is what Em would need for a retirement nest egg: $6,708,059. This would represent the high side retirement savings target. For reference, this number is close to the T.Rowe Price calculator estimate of $7,427,816, which did not include Social Security payments.

Disclaimer: Examples are illustrative purposes only. Your results will vary with different inputs and assumptions. As with all retirement calculators, please consult with your financial advisor before taking any actions.

Photo Credit: morgueFile.com, Emily Roesly

5 number summary online calculator

Fair Tax Calculator written in FLEX!

Have fun: http://www.fairtax.org/site/PageServer?pagename=calculator

zero factor property calculator

Solve Your Maths Problem with Tutor Vista

Often the case the parents have difficulty in guiding their children at home, especially if the child has difficulty doing math, especially if your child was in K-12. Your child needs help to understand math and algebra concepts, as you know that 90% is to be understood, while the remaining 10% to be memorized. This tutorial now has developed online, allowing your child can follow this tutorial from home via the internet.

In addition, if your child has difficulty with their homework, Tutor vista can also help your child to solve his homework online by using homework help menu. In this tutorial, there are also menus to solve the problems of mathematics, algebra, and trigonometry. Their tutors are always ready and willing to help you anytime on! line 24 hours a day and seven days a week. Tutor vista also provides tutoring for all math problems such as, equation, fractions, simplify and solving equations.

If you still doubt of their service, Tutor Vista also provide demo for free where you can try their services So, What are you waiting for? Just join Tutor Vista and see the result for yourself.

tutorvista demo

Trouble with Math? Get some online Math Tutoring.

TutorVista is the leading online tutoring company in the world. They offer an incredible unlimited monthly tutoring package for only $99.99 a month for all subjects - students can use their service as much as they want, whenever they nee! d it. Tutoring is available 24/7. They provide free demo for first time users where they can try the service for free.

TutorVista's online Math Help is designed to help you get the desired edge in acing the subject.

Get help in understanding algebra, calculus, precalculus, geometry, trigonometry, statistics, probability, linear programming, discrete mathematics across K-12 with their online Math tutoring program. Whether you need Math help or some quick assistance in solving Math problems before a test or an exam, their online Math tutors can help. Their tutors provide you with instant help, homework help and help with assignments in Math.

Math Help at a very affordable price

The advantage with the! ir Online Math help is that you can connect with a tutor using your PC and get personalized attention and one-on-one tutoring at a fraction of what a learning center will cost you. Also you don't waste time in travel since you study online with an online Math tutor.

Get Online Math Tutoring from the best Online Math tutor

They have online Math tutors who are experts in the subject across K-12 and beyond. ! Whatever your requirements are, the rigor and discipline of th! e TutorV ista tutor certification program will ensure that you get all that you want and more in your Math tutor. Their tutors are familiar with the National and various State Standards required across grades in the US.

Stydying Math Online is fun with TutorVista

With TutorVista's online Math tutoring and Math Homework help, studying the subject becomes easy and fun for students. Under the e! xpert guidance of our tutors, students excel in all Math related problems.

TutorVista's Online Math Tutoring gets you ahead

With TutorVista's online Math tutoring, students understand Math concepts and learn to solve Math problems quickly and easily. TutorVista sessions are just like having a tutor besides you at hom! e or in a classroom. The tutor and student talk to each other ! using vo ice (VoIP) and share an interactive whiteboard to work problems, simulations, assessments and other tasks. The one on one interactive session with the tutor helps you get an edge in the subject.

Free Online Math Help

TutorVista also offers a free demo service. Using their demo service you get free online Math help and experience the benefits of our tutoring yourself.

Come join their online Math tutor! ing program today and experience the unique TutorVista Advantage!

Learn Math with TutorVista - Get online Math tutoring, homework help anytime, anywhere.

tutorvista demo session

Stock Chart Pattern - Cranes Software (An Update)

The stock chart pattern of Cranes Software brings to mind a few stock market cliches:

1. Never try to catch a falling knife - you are supposed to wait for the knife to hit the table first, where it is likely to vibrate for a while; then it is safer to catch it. Question is: do you want to? (In the case of Cranes Software, some one seems to have removed the table which was covering a bottomless hole!)

2. Just because a stock is trading cheap, doesn't mean it can't trade cheaper.

3. Never average down in price; average up instead, because you don't know how low it can go.

The bar chart pattern of the Cranes Software stock from Mar '09 till date shows that ambition and the pursuit of growth needs to be tempered with financial prudence and patience - otherwise it may lead to annihilation:-

When I wrote about the stock back in July '09, it had made a double-bottom - 35 in Mar '09 and 34 in Jul '09 - and tried to move up. The resistance from the 50 day EMA proved too strong and the stock moved down again to 33.5 in Aug '09.

An up move on good volumes took the stock above the 50 day EMA, but a double-top at 48 proved to be its last hurrah. The stock dropped below the 50 day EMA in Oct '09 and has stayed below it till date.

A long-term support-resistance line has been drawn at 33. That level supported the stock's fall four times (marked by up arrows). This provides a cla! ssic example about support-resistance levels - which act more ! like a t hin membrane than a spring. Each test of the support (or resistance) weakens it.

After three or four tests, the support (or resistance) tends to break. Thereafter, the support usually turns into a resistance, and a resistance turns into a support. Note that after the convincing break below the support of 33 in Dec '09, the level provided resistance in Jan '10 (marked by the down arrow), and then the bottom fell out of the stock.

The MACD has remained negative since Oct '09. The RSI and slow stochastic have once again entered oversold zones.

For those who did not read my earlier analysis in July '09, the concluding paragraph is quoted below:

"The stock chart pattern of Cranes Software is a reminder of what can happen if the pursuit of growth by acquisition leads to too much debt. Even good cash flows from operations may not be enough to survive. This is not for the faint-of-heart. Intrepid investors should maintain strict stop loss at! Rs 33."

Technical analysis is not perfect. But if you don't know the basics, it can hurt you where it hurts the most in the stock market. Your wallet!

Bottomline? The stock chart pattern of Cranes Software shows that its glory days during the previous bull market are long gone, and now it is just a struggle for survival. If you own the stock, get out now. If you think it can't go lower, think again. It is game, set and match for the bears.

(Question for readers: what do you think the volume action may indicate?)

Related Post

About Support and Resistance levels in stock chart patterns

times table chart up to 100

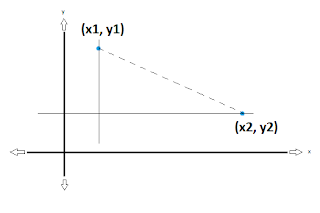

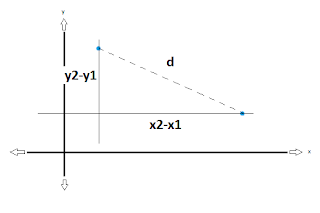

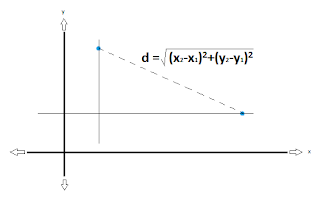

Distance formula - Part II

solve help math